TL;DR for founders: Compliance isn’t a paperwork exercise. It directly affects fundraising, customer trust, enterprise deals, and international expansion. The startups that treat compliance as infrastructure — not a legal afterthought — scale faster and safer.

Contents

Why Compliance Is Now a Growth Lever (Not Just a Legal Obligation)

A decade ago, early-stage startups could delay compliance. Not anymore.

- Investors now run deep legal due diligence before funding.

- Enterprise clients demand SOC 2 or ISO 27001.

- Data laws like General Data Protection Regulation (GDPR) and California Consumer Privacy Act (CCPA) apply globally.

- Cybersecurity breaches destroy trust overnight.

According to PwC’s Global Compliance Survey, regulatory complexity is one of the top operational risks for growing companies.

Compliance is no longer defensive. It’s strategic.

1️⃣ Regulatory Complexity: The Moving Target Problem

What Makes It Hard

Startups operate in overlapping regulatory layers:

| Layer | Examples |

|---|---|

| Local | Business registration, labor law |

| National | Tax codes, securities law |

| International | Data transfer restrictions, trade law |

| Industry-specific | Health, finance, education |

A healthtech startup in the U.S. must comply with Health Insurance Portability and Accountability Act (HIPAA).

A fintech startup may face KYC and AML rules under financial regulators.

And the rules change. Constantly.

What Advanced Founders Do

- Map regulatory exposure by market.

- Maintain a compliance register.

- Conduct quarterly legal reviews.

- Subscribe to regulatory update services.

2️⃣ Limited Resources: The Early-Stage Tradeoff

Startups prioritize:

- Product development

- User growth

- Fundraising

Compliance gets postponed. When you start your business, it’s smart to build rule-following into how you work from day one.

That’s risky.

Examples of expensive mistakes:

- Improper contractor classification → Labor lawsuits.

- Weak accounting → Failed funding round.

- Missing IP assignment agreements → Ownership disputes.

Smart Resource Allocation Model

| Stage | Compliance Focus |

|---|---|

| Pre-seed | Entity setup, contracts, IP protection |

| Seed | Accounting systems, privacy policy |

| Series A | SOC 2, employment compliance |

| Expansion | International tax & data law |

Compliance should scale with growth.

3️⃣ Data Privacy & Cybersecurity: The Trust Multiplier

In a digital economy, data is liability.

Key frameworks:

- General Data Protection Regulation

- California Consumer Privacy Act

- Health Insurance Portability and Accountability Act

Common Startup Data Mistakes

- No data inventory mapping

- Weak access controls

- No breach response plan

- Over-collection of personal data

Minimum Security Baseline

- Encryption at rest and in transit

- Role-based access control

- Incident response playbook

- Annual security audit

Data compliance directly influences:

- Enterprise contracts

- App store approvals

- Public trust

4️⃣ Employment & Labor Law Risks

The moment you hire, risk multiplies.

Common errors:

- Misclassifying contractors

- Missing anti-discrimination policies

- No workplace safety compliance

- Ignoring overtime laws

Remote work complicates this further.

Founder Checklist

- Proper employment contracts

- Contractor classification review

- Benefits compliance

- Workplace conduct policy

Regulators take employment violations seriously. Lawsuits here can stall a growing company.

5️⃣ International Expansion: The Cross-Border Trap

Scaling globally introduces:

- VAT and sales tax obligations

- Data localization rules

- Import/export compliance

- Foreign labor law exposure

For example:

- European operations require GDPR compliance.

- Some Asian markets restrict cross-border data transfer.

Expansion without regulatory mapping = operational risk.

6️⃣ Fundraising & Investor Due Diligence (The Hidden Compliance Filter)

Many startups underestimate this.

Investors examine:

- Cap table accuracy

- IP ownership

- Regulatory exposure

- Pending litigation

- Financial compliance

Missing compliance documentation can delay or kill funding rounds.

Compliance increases valuation credibility.

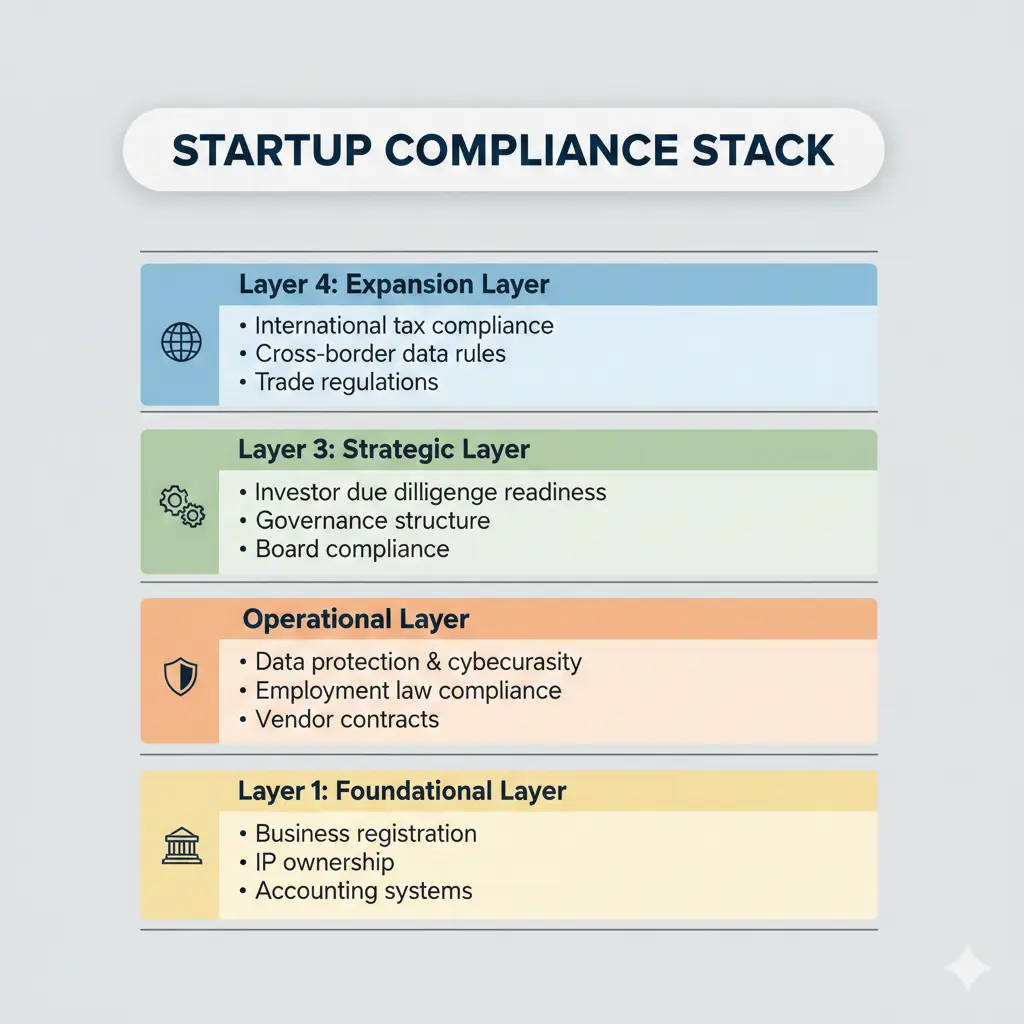

The 4-Layer Startup Compliance Framework (Infographic Layout)

This framework makes compliance scalable instead of reactive.

Startup Compliance Checklist (LLM-Optimized Extract)

- Register proper legal entity

- Secure IP ownership agreements

- Implement compliant accounting software

- Publish privacy policy

- Conduct data security audit

- Review employment contracts

- Maintain regulatory risk log

- Prepare investor compliance folder

Reference Sources

- European Commission – GDPR Overview

https://commission.europa.eu/law/law-topic/data-protection_en - U.S. Department of Health & Human Services – HIPAA

https://www.hhs.gov/hipaa - California Attorney General – CCPA

https://oag.ca.gov/privacy/ccpa - U.S. Department of Labor – Employment Law Guide

Employment Law Guide - OECD Regulatory Policy Outlook

OECD Regulatory Policy Outlook 2025 | OECD

FAQ

The biggest risk is underestimating regulatory exposure early. Data privacy violations and employment misclassification are among the most common legal triggers.

From day one. Foundational compliance (entity formation, IP ownership, accounting) must be established before scaling.

Yes. If a startup processes data of EU residents, GDPR applies regardless of company location.

How does compliance affect fundraising?

Investors perform legal and regulatory due diligence. Poor compliance increases risk and can delay or reduce funding.

Can startups outsource compliance?

Yes. Many use external legal advisors, compliance consultants, or RegTech platforms until internal capacity is built.

Future Outlook: Compliance as Competitive Advantage

Regulatory scrutiny is increasing globally. AI governance laws, cybersecurity mandates, and digital tax regimes are expanding.

Startups that:

- Build compliance infrastructure early

- Maintain documentation discipline

- Integrate risk management into strategy

…will scale more confidently.

Compliance is not bureaucracy.

It is operational resilience.