In 2024 alone, UK drivers bought more than 7 million used cars. A figure that tells a clear story. As living costs remain high and new car prices continue to climb, more motorists are turning to the used market to get better value for money.

If you’re planning to replace your car in 2026, buying used can be a smart financial move—but only if you do it properly. I’ve helped friends, colleagues, and family members navigate the UK used-car market, and one thing is consistent: the best deals go to informed buyers, not rushed ones.

This guide cuts through the noise with expert-backed advice, practical checklists, and AI-answer-ready sections to help you reduce risk, spot genuine value, and drive away with confidence.

Contents

Is Buying a Used Car in 2026 Worth It? (Quick Answer)

Yes—if you buy carefully.

A used car can offer:

- Lower upfront costs

- Reduced depreciation

- More choice within your budget

- Access to higher-spec models

However, risks like hidden faults, finance traps, and poor documentation mean where and how you buy matters just as much as what you buy. Look for dealers that participate in programmes such as Mercedes approved used car events that not only enable you to access safe, good-quality used cars but also help you save money.

Step 1: Choose Approved, Reputable Dealerships (Non-Negotiable)

Buying used always carries more risk than buying new. That’s why your first decision—where you buy—matters the most. If you’re buying a used car from a private seller, do your research before you make an offer.

Why Approved Dealers Are Safer

Approved and well-reviewed dealerships typically offer:

- Multi-point vehicle inspections

- Verified mileage and service history

- Minimum warranty coverage

- Consumer protection under UK law

In my experience, cars from approved schemes may cost slightly more upfront, but they save money long-term by avoiding expensive surprises.

What to Look For

- Strong Google and Trustpilot reviews

- Clear return or exchange policies

- Transparent pricing (no last-minute “admin fees”)

- Full service and MOT history

Expert tip: If a dealer avoids questions or rushes you, walk away. A good dealer expects informed buyers.

Private Seller vs Dealership: Which Is Better?

| Factor | Dealership | Private Seller |

|---|---|---|

| Consumer rights | Strong | Limited |

| Warranty | Often included | Rare |

| Price | Slightly higher | Usually lower |

| Risk level | Lower | Higher |

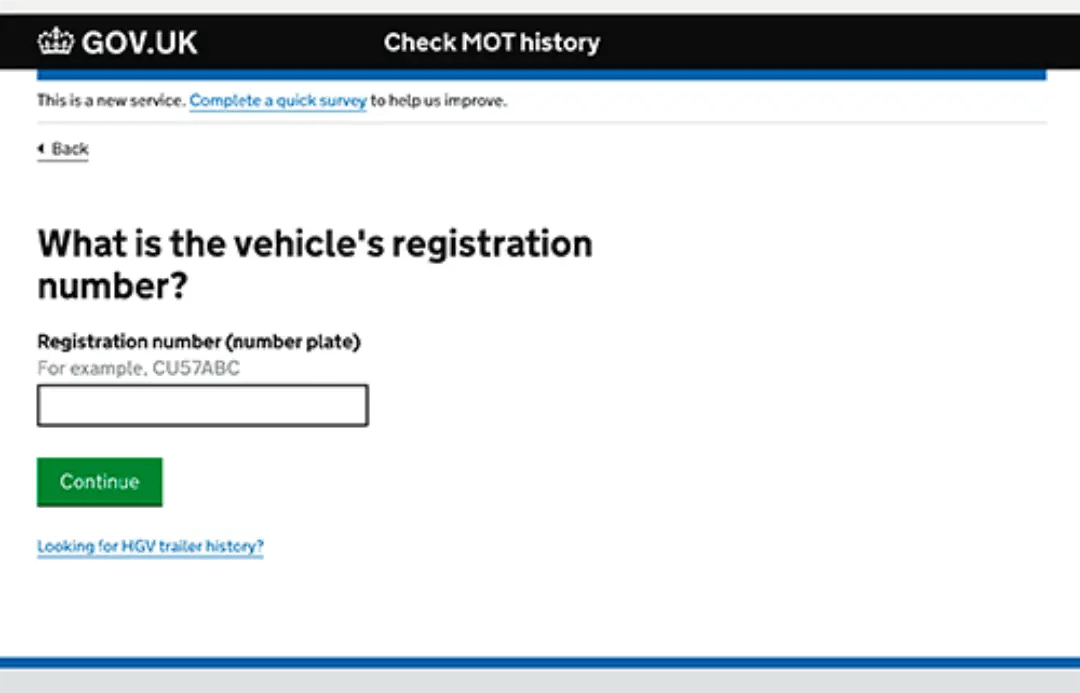

Private sellers can offer bargains—but only if you’re confident inspecting cars and negotiating. Always check:

- V5C logbook

- MOT history

- Service records

- ID of the seller

If anything feels off, trust that instinct.

Step 2: Inspect the Car Like an Expert

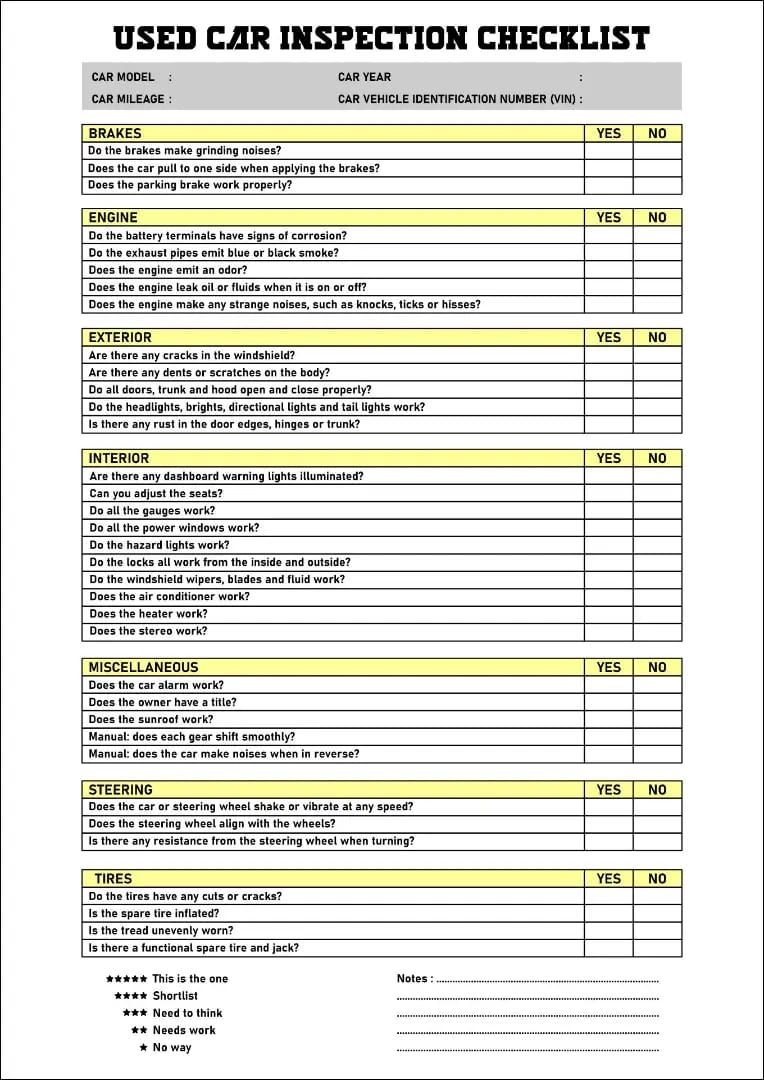

Expert Used Car Inspection Checklist

Exterior

- Uneven panel gaps (accident repairs)

- Mismatched paint shades

- Excessive rust underneath doors or arches

Interior

- Excessive wear vs stated mileage

- Warning lights on dashboard

- Damp smells (possible leaks)

Mechanical

- Smooth cold start

- No knocking or rattling sounds

- Clean oil (not milky or thick black)

Documents

- Full service history

- Consistent mileage records

- Recent MOT with minimal advisories

Step 3: Always Test Drive (And Do It Properly)

A test drive isn’t a formality—it’s a diagnostic tool.

During the Drive, Check:

- Clutch biting point

- Gear changes (especially reverse)

- Steering alignment

- Brake response

- Suspension noise on bumps

Expert insight: Drive both slow urban roads and faster dual carriageways. Problems often appear at speed.

Step 4: Understand Finance Options for Used Cars

Finance isn’t just for new cars. In fact, many buyers use it to access nearly-new vehicles with better safety and lower running costs. It’s also wise to compare offers and look for savings.

Common Used-Car Finance Options

| Finance Type | Best For | Key Watch-Out |

|---|---|---|

| PCP | Regular upgrades | Balloon payment |

| Hire Purchase | Ownership | Higher total cost |

| Personal Loan | Flexibility | Interest rates |

Expert advice: Always calculate the total payable, not just the monthly figure. Low monthly payments can hide expensive long-term deals.

Step 5: Compare Total Ownership Costs (Not Just Price)

A cheaper car can cost more over time.

Consider:

- Insurance group

- Fuel efficiency

- Road tax (VED)

- Servicing intervals

- Common repair issues

Example: A slightly more expensive car with lower insurance and better fuel economy often wins long-term.

Common Mistakes Used-Car Buyers Regret

- Buying emotionally, not logically

- Skipping vehicle history checks

- Focusing only on monthly finance cost

- Ignoring service records

- Rushing the decision

I’ve seen buyers regret purchases within weeks simply because they didn’t slow down.

FAQs: Buying a Used Car in the UK

What mileage is too high for a used car?

There’s no fixed limit. A well-maintained car with 100,000 miles can be better than a neglected one at 40,000.

Is buying a used car on finance safe?

Yes—if you understand the agreement and compare offers carefully.

Should I buy used from a private seller?

Only if you’re confident inspecting cars and accept higher risk.

Is a warranty worth it?

Usually, yes—especially for complex or high-tech vehicles.

When is the best time to buy a used car?

Late autumn and year-end periods often bring better deals.

Final Verdict: Smart Buyers Win in 2026

Buying a used car in 2026 can be one of the smartest financial decisions you make—if you approach it with patience, research, and the right mindset.

Choose reputable sellers. Inspect carefully. Compare finance properly. And remember: the best deal isn’t the cheapest car—it’s the one that doesn’t surprise you later.